Digital Wallets in Thailand: A Deep Dive into Google Pay and Apple Pay

The pandemic imparted a feeling of fear towards using cash, and though contactless transaction methods were generally accessible in different nations, Thailand just saw its popularity during the pandemic. Mobile banking and PromptPay have become a fundamental piece of our lives.

Presently, Google Pay is stepping up the versatile contactless payment by placing all the features in only one application. Keeping in mind that applications like these are typical beyond Thailand, the Android application just took off as of late, much to the enjoyment of the citizens and Android users.

Google Pay and Wallet in Thailand

The Google Pay application began operation on September 19, 2001. It enabled clients to pay with Android devices like watches, smartphones, or tablets. For a long time, the application has been in use in many countries. Now, it is in Thailand, making payment much simpler than using a QR code.

With a tap of the telephone or their watch, users in Thailand will have the option to save credit cards and make payments. Many banks have used cardless ATMs; however, you will not need to carry your Mastercard around with Google Pay. Currently, it is only compatible with KTC Visas and Bangkok Bank credit cards. With time, more banks will be added.

Besides payments, Google Wallet allows you to store tickets when flying, thus eliminating the need for paper passes. This makes it easier to travel.

🚀 Expat Fact!

Among the 5,021,077 recorded internet-based transactions, 26% are from Google Pay.

Advantages of Google Pay for Your Business

Google Pay provides a lot of advantages for buyers. Using Google Pay implies that your clients can utilize it to pay either face-to-face or online. It also provides them with various choices for how to make payments; they can utilize the application, a QR code, or a telephone number. This makes the entire transaction much smoother and more adaptable on their end. This eliminates many boundaries that could prevent them from making a successful transaction.

Regardless of what payment platform you use in Thailand, having a total and precise record of every transaction is fundamental. Google Pay tracks payments, so all the data you want is available. Lastly, it is very safe to use. Google Pay has built-in security measures to ensure you never need to stress over fraud or privacy breaches.

Challenges of Using Google Pay

Notwithstanding every one of the advantages mentioned above, there are a couple of things to remember about Google Pay. Since it's an emerging payment platform, it's not widely used like other options. Additionally, a few banks are yet to acknowledge Google Pay. Try to confirm if your bank account can be linked to it.

One more potential issue is that payments made through Google Pay aren't always immediate. The time it takes to receive a payment relies on how the client sends it; it'll require 3-5 days to be processed if they pay through a bank account. This delay is caused more by the bank than by Google Pay; however, being aware is helpful.

As Google Pay turns out to be more famous, all things considered, more banks will begin to support it. Moreover, even though you could encounter delays when a client pays with their bank account, you'll get the payment either in a split second or within a couple of hours when they pay through a card or their Google Pay balance. For most companies, the advantages of Google Pay far offset these issues.

Apple Pay in Thailand

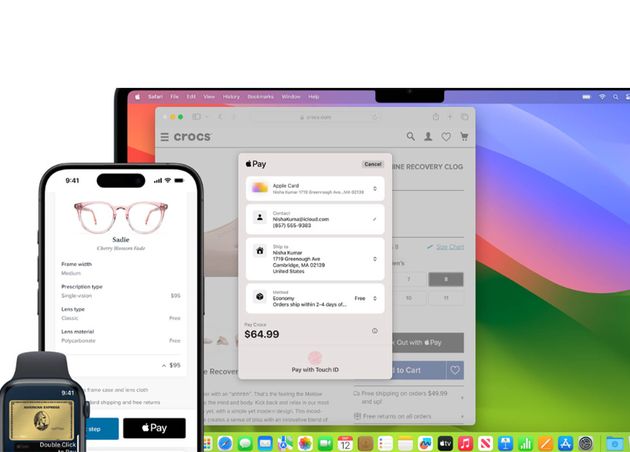

Apple Pay is a portable payment offered by Apple Inc. that permits clients to make payments face-to-face, on the web, or with iOS applications. It is compatible with iPhone, iPad, Macintosh, and Macintosh Watch. It digitizes and can substitute a debit or credit card chip and even PIN transaction at a POS terminal with contactless capability.

It doesn't need Apple Pay-explicit contactless terminals; it can work with any dealer that acknowledges contactless payments. It adds two-factor verification through Face ID, Touch ID, password, or PIN. Gadgets communicate wirelessly with POS frameworks by using an embedded secure element (eSE) with near-field communication (NFC) to safely store transaction information and carry out cryptographic roles, and Apple's Face ID and Touch ID for biometric confirmation.

Apple Pay can also be utilized for some public transportation services using dedicated travel or debit/credit cards. To pay at a POS, users hold their verified Apple device to the NFC card reader of the POS. iPhone users carry out authentication by utilizing Face ID, Touch ID, or passcode, while Apple Watch users validate by double tapping a button on a device.

To pay in compatible iOS applications, users pick Apple Pay as their payment method and verify with Face ID or Touch ID. Clients can add cards to the platform in any of four different ways: by manually entering the card details, by snapping a picture of the card, through the payment card on their iTunes accounts, or by being provisioned from inside the application of the card issuer.

🚀 Expat Trivia

Payments made using Apple Pay represent 5% of all card payments.

Advantages of Apple Pay for Products and Services

Apple Pay can function in many nations where Visa cards can be used. But bear in mind that not all businesses accept Apple Pay in every country. You can visit their website if you are unsure if a merchant accepts Apple Pay.

One of the world's biggest Visa card providers, Lloyds Bank, is a worldwide financial organization. With Lloyds Cash card and Apple Pay, anyone in Thailand can shop and pay for products and services in over 60 nations. Any place you are on the planet, you can use your card since Lloyds doesn't charge a transaction fee for foreign currencies as numerous card providers do.

With the arrival of Apple Pay Cash, users can now easily and rapidly transfer money to their bank accounts. Customers can now use Apple Pay Cash to pay for iPhones with a bank debit card. Users can also easily transfer cash between their Apple Pay Cash account and bank account balance, and it's great for when you need more money.

Customers in Thailand can use Apple Pay Cash by opening the Wallet application on their iPhones and tapping the Apple Pay Cash card. Then, in the upper right corner of the card, tap the three there, and tap on transfer to bank. To guarantee that Apple Pay will work with your iPhone, attempt to manually choose a credit card from your Wallet application and check whether the terminal will work with Apple Pay.

You can also change your credit card in the Wallet application, sign out, and sign in with your Apple ID. Apple Pay Money is an extraordinary feature added to the Wallet application to help you transfer funds to your own bank account quickly and easily, and it can be used together with the application.

Using Apple Pay in Thailand

Double-tap the home button to access the Apple Pay app if your iPhone is locked. You can tap your debit card on the Touch ID and then tap Wallet. NFC/tap and pay and Apple Pay decals can be displayed on different stores' windows to let you know if a service station, store, eatery, or other business accepts Apple Pay.

You can utilize Apple Pay to add a computerized variant of a credit or debit card to your Wallet. You can use Apple Pay to shop online, in applications, and without using your credit cards, cash, or a different account. When you first on a new gadget, it will walk you through how Apple Pay can be set up.

It is feasible to utilize Apple Pay to make on the app and online purchases on the Macintosh and iPad. Apple Pay requires a two-factor confirmation code to access the payment platform. You should first activate an Apple cash card to send and receive funds through the Messages application. Clicking the pay button is all you need to do while transacting with Apple Pay.

Even though users get prompt notification of the transaction, the Apple Pay framework is certainly not for instant payment because the money moved between counterparties isn't instant. The completion time relies on the payment method which the user chooses.

Google Pay versus Apple Pay

Google Pay's principal rival is Apple Pay, which offers many similar features and benefits. The clearest distinction is that Apple Pay is meant for iOS applications, while Google Pay is focused on Android users. Yet, it's not exactly that basic.

It's critical to note that while Apple Pay is only accessible to users with iPhones and other Apple gadgets, Google Pay offers applications for both Android and iOS. All in all, it doesn't discriminate. Anybody can use it, regardless of what sort of gadget they have.

Right now, Apple Pay is more popular than Google Pay. However, this depends on the region and is liable to change. In any case, the ideal way to care for all clients is to accept payment through Google Pay and Apple Pay.

Recommended for you

Top 10 Best and Most Popular Phuket Nightlife Venues

Rowan (Guinness Bear)

Artificial Intelligence in Shrimp Farming: A New Era of Innovation

Riley Sinclair (Digital Aqua Bear)

Travel to Thailand: The Best Way to Budget

Dr. Theodore (Professor Bear)